Pros And Cons Of Purchasing A Home With An HOA (Homeowners Association)

Homeowners associations (HOA’s) can be an attractive aspect of a community or a complete dealbreaker for homebuyers. If you find yourself searching for homes with an HOA but aren’t quite sure how you feel, today’s blog post may be able to deliver some clarity.

Before we get into pros and cons of HOA’s, let's first discuss what they are. A homeowner’s association is an organization within a neighborhood, subdivision or condominium that is in charge of creating and enforcing rules and regulations for the properties within the community.

Pros of an HOA

-Amenities. HOA’s typically will offer and manage amenities such as pools, parks, tennis courts and community centers, all of which are assessable to community members.

-Maintenance. HOA’s will typically handle all community maintenance including snow removal, trash pickup, landscaping and the upkeep of private roads.

-Appearance. HOA’s oversee and ensure the community is neat at all times. This is especially nice if you are in the process of selling your home as a clean neighborhood is appealing to potential buyers.

-Mediator. HOA’s are able to step in if a conflict were to arise with a neighbor or fellow community member. Turning issues over to the HOA is a great way to ensure the issue is resolved fairly, making it easier for both parties involved.

Cons of an HOA

-Cost. The cost of an HOA can vary based on property and the amenities that are provided, but an added cost nonetheless.

-Fines. It is important to fully understand what is expected from you as a homeowner in a community with an HOA to avoid being penalized with unexpected fines and fees.

-Rules. Some people are turned off from HOA’s because they are told what they can and can’t do with a property they own. Things such as exterior paint color, dimensions of fencing, how tall your grass can be, the number of pets you can have and type of window coverings that are visible from the street are all things HOA’s can dictate.

Choosing the best home and neighborhood for your needs is of utmost importance to our team. Please contact us with any questions you may have and check back to view our blog weekly for great home buying and selling tips!

Before we jump into the main topic of today’s blog post, it is important to understand exactly what a foreclosure is. A foreclosure is a property that has been seized by the bank who originally gave the owner the loan. In each mortgage contract there is what’s called a ‘lien’ on the property which allows the bank to take control of the property in the event the borrower fails to make mortgage payments.

Before we jump into the main topic of today’s blog post, it is important to understand exactly what a foreclosure is. A foreclosure is a property that has been seized by the bank who originally gave the owner the loan. In each mortgage contract there is what’s called a ‘lien’ on the property which allows the bank to take control of the property in the event the borrower fails to make mortgage payments.  Real estate terminology can really throw you for a loop, especially if you are a first-time home buyer and haven’t dealt with the home buying process before. If you can relate, then we are sure you will enjoy (and benefit from) today’s blog post!

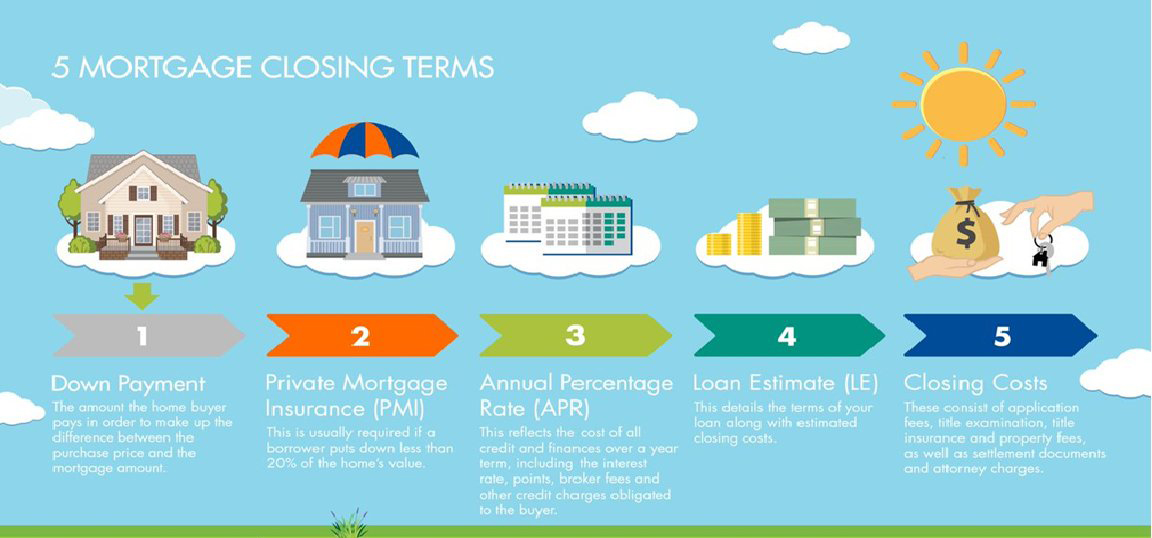

Real estate terminology can really throw you for a loop, especially if you are a first-time home buyer and haven’t dealt with the home buying process before. If you can relate, then we are sure you will enjoy (and benefit from) today’s blog post!  We understand how confusing the home buying process can seem, especially for first time home buyers. And along your journey you may find new words and phrases being thrown in your direction that you have never heard before - let alone know how to define – and it makes everything seem a little more, well, complicated. We get it and that is why we have dedicated today’s blog post to simplifying five common mortgage closing terms. Our hope is that alongside this newfound knowledge will come confidence and understanding, in turn allowing you to enjoy the buying process a little more!

We understand how confusing the home buying process can seem, especially for first time home buyers. And along your journey you may find new words and phrases being thrown in your direction that you have never heard before - let alone know how to define – and it makes everything seem a little more, well, complicated. We get it and that is why we have dedicated today’s blog post to simplifying five common mortgage closing terms. Our hope is that alongside this newfound knowledge will come confidence and understanding, in turn allowing you to enjoy the buying process a little more!