What is a Principal Only Mortgage Payment?

Today more than ever we are all looking for ways to save money and one of our largest expenditures is our mortgage. While monthly budgets can get tight, utilizing a little extra money to pay down our largest expenditures can pay off BIG in the end. Here we’re going to look at ‘principal only’ mortgage payments and the effect they can have on your finances.

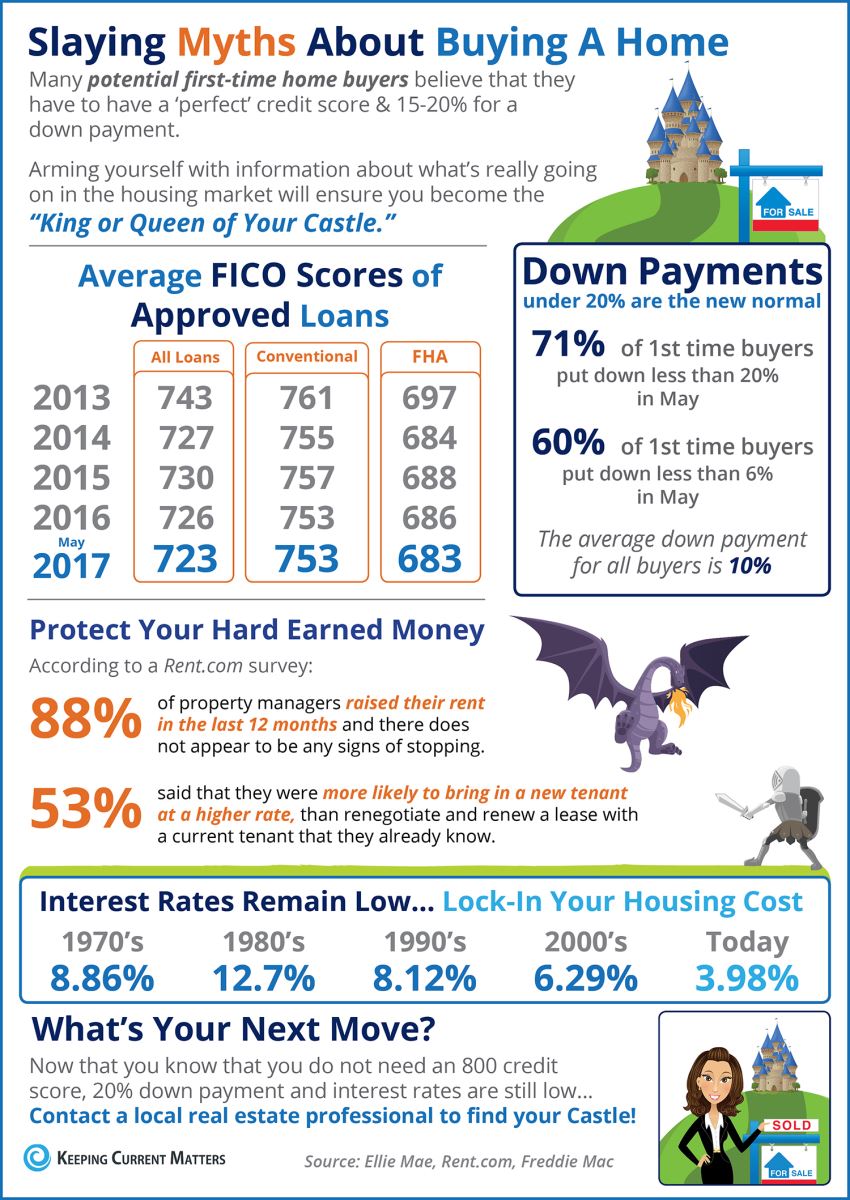

When you purchase a home and secure a mortgage through a lender, you are paying several components of that mortgage.

- The principal- the amount of the loan needed to purchase the home.

- Interest on that loan- a monthly interest payment calculated on the interest rate accessed to the loan.

- If you put down less than 20% you are also paying PMI (private mortgage insurance)

- Property taxes

- You may also have your Homeowners Insurance tied into the loan as well and pay a monthly premium for that.

These 5 components make up your monthly mortgage payment. However, the principal component of the mortgage represents the amount of equity you accrue each month and essentially ‘buy-back’ from your mortgage lender.

If you currently have a 30-year mortgage, and never make any additional payments, it will take you 30 years to pay off the mortgage in full and pay the full amount of interest associated with the mortgage. For example, a $350,000 loan with a 5% interest rate would be $17,500 a year paid in interest alone!!!

By making a principal-only payment, in addition to your monthly mortgage payment, you are paying down the principal amount of your mortgage faster. If you were to pay a $100 principal-only payment today at the 5% interest rate, you’ll save $332 over 30 years. Now imagine doing that every month, or more if you can. It will put equity in your pocket much quicker, pay off the principal and loan faster and save you thousands of dollars in interest over the course of your loan.

Please don’t confuse making additional mortgage payments with a principal-only payment, as they are very different. If you choose to start making principal-only payments- in addition to your regular monthly mortgage loan payment, we suggest you call your lender and have them walk you through the process, so it is done correctly, and the monies are applied appropriately. Remember, a principal-only payment NEVER takes the place of your regular monthly loan payment. That must always be made monthly and on time. This would be an additional payment to help pay down the principal amount of your loan. Any questions regarding your loan should ALWAYS be directed to your lender.

___________________________________________________________________________________

Are you looking for a home in the Omaha area right now? Our team is ready to be our local experience knowledge and expertise to work for you! If you’re ready to begin the exciting home-buying journey, reach out! The Heim-Berg Team- 402-677-9024