Looking To Calculate The True Cost Of Home Buying In Omaha, NE? Here Are A Few Lesser-Known Fees To Factor In

Let’s be honest - no matter how you spin it, buying a home is not cheap. And whether you are a first-time homebuyer or a seasoned professional, we are sure the previous sentence comes as no surprise to you (you may have even found yourself nodding and smirking in agreeance). But what many people tend to focus on are the larger costs that are associated with home buying, such as mortgage payments and down payment costs, and many tend to overlook the lesser fees that may arise during the buying process. But fear not, as after today’s blog post we are confident you will leave with a better, more thorough understanding of not only what these fees are, but also what they could end up costing, so you can plan accordingly.

Let’s be honest - no matter how you spin it, buying a home is not cheap. And whether you are a first-time homebuyer or a seasoned professional, we are sure the previous sentence comes as no surprise to you (you may have even found yourself nodding and smirking in agreeance). But what many people tend to focus on are the larger costs that are associated with home buying, such as mortgage payments and down payment costs, and many tend to overlook the lesser fees that may arise during the buying process. But fear not, as after today’s blog post we are confident you will leave with a better, more thorough understanding of not only what these fees are, but also what they could end up costing, so you can plan accordingly.

-Application Fees: When you are applying for a loan, your lender will pull your credit report to get a better understanding of your financial health to see what you qualify for. They in turn will charge you an application fee, which is usually combined with the credit report fee. You should be sure to request a breakdown of the fees, but this can cost you $75-$300 dollars.

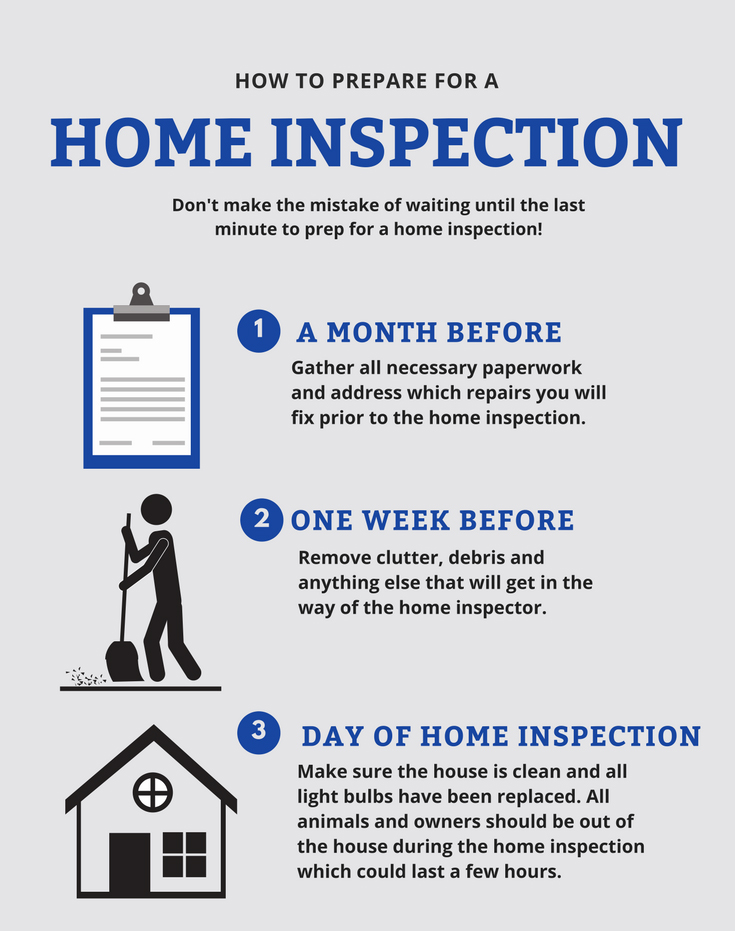

-Home Inspection: When it comes to home buying, planning for a home inspection is curial. Think of it as an extra layer of protection to ensure you are not purchasing a home with major hidden issues that can mean huge dollar signs down the road. During the appointment, the inspector will search for general and structural issues within the home, many times finding things not visible to the naked eye. Home inspections can cost between $300 and $500.

-Private Mortgage Insurance (PMI): If you are planning to put down less than 20% of the home’s purchase price, the lender will most likely require you to purchase private mortgage insurance. This will protect the lender in the event that you stop making payments on your loan. And while PMI rates can vary, they tend to hover around 0.3% to 1.5% of your original loan amount annually.

-Title Services: Fees such as government filing fees, title search of public records for the property, notary fees and more are covered under title services. It is crucial for you to get a line item breakdown for each cost, and you should budget around $150 to $400.

-Appraisal Fee: First, the appraisal itself can cost between $200 and $425 and take around two hours to complete. Next, the appraisal report is then sent to the lender to confirm that the property is indeed worth the amount that was agreed upon.

With Father’s Day right around the corner, now is the perfect time to fill your calendar with events and activities in and around our beautiful city of Omaha, NE. Spend your weekend celebrating dad and creating beautiful memories while taking in a baseball game, indulging in a walking food tour, roaming farmer’s markets, tackling a mini mud run, exploring art exhibits and much more! We have listed these and a few other can’t-miss events below for you to check out. Enjoy, and Happy Father’s Day!

With Father’s Day right around the corner, now is the perfect time to fill your calendar with events and activities in and around our beautiful city of Omaha, NE. Spend your weekend celebrating dad and creating beautiful memories while taking in a baseball game, indulging in a walking food tour, roaming farmer’s markets, tackling a mini mud run, exploring art exhibits and much more! We have listed these and a few other can’t-miss events below for you to check out. Enjoy, and Happy Father’s Day!  We all know how stressful moving can be – packing your entire life into cardboard boxes, hauling everything away in a rented truck and, finally, attempting to make sense of all the chaos after the final box is unloaded. We get it. In an effort to alleviate some of that stress (and the overwhelming feeling of sheer panic at times), we have listed ten moving hacks below. We are sure they will aid in your moving process and help to keep things organized and running smoothly from start to finish.

We all know how stressful moving can be – packing your entire life into cardboard boxes, hauling everything away in a rented truck and, finally, attempting to make sense of all the chaos after the final box is unloaded. We get it. In an effort to alleviate some of that stress (and the overwhelming feeling of sheer panic at times), we have listed ten moving hacks below. We are sure they will aid in your moving process and help to keep things organized and running smoothly from start to finish.  Hello weekend, we missed you! Below we have listed a few can’t-miss events and activities that are happening in and around our beautiful city of Omaha, NE this weekend. So grab your family and friends for a few days filled with everything from comedy shows and art festivals, to walking food tours, aircraft exploration events, farmers markets, dinosaur activities, yoga in the forest and so much more!

Hello weekend, we missed you! Below we have listed a few can’t-miss events and activities that are happening in and around our beautiful city of Omaha, NE this weekend. So grab your family and friends for a few days filled with everything from comedy shows and art festivals, to walking food tours, aircraft exploration events, farmers markets, dinosaur activities, yoga in the forest and so much more!  With spring coming to an end, we are quickly approaching the time of year where many families head out for their long-awaited summer vacations. Whether you are jet setting to a foreign country, packing the car for a road trip or relaxing in the sun on a tropical getaway, you want to enjoy your vacation with the peace of mind knowing your home is safe and secure back in Omaha, NE. And that is where we come in! We have packed this blog post with tips and tricks to help make your house burglar-proof, so you can return home relaxed, refreshed and a little sun-kissed.

With spring coming to an end, we are quickly approaching the time of year where many families head out for their long-awaited summer vacations. Whether you are jet setting to a foreign country, packing the car for a road trip or relaxing in the sun on a tropical getaway, you want to enjoy your vacation with the peace of mind knowing your home is safe and secure back in Omaha, NE. And that is where we come in! We have packed this blog post with tips and tricks to help make your house burglar-proof, so you can return home relaxed, refreshed and a little sun-kissed.  As we say goodbye to May and welcome June, this weekend is the perfect time to get out of the house and explore all the fun events and adventures our beautiful city of Omaha, NE has to offer. We have listed a few can’t-miss activities for you to check out below. Spend the weekend tasting delicious new recipes on a walking food tour, try a new tune at karaoke, pick up fresh, local food at the farmer’s market and go backstage at the aquarium for a day to remember!

As we say goodbye to May and welcome June, this weekend is the perfect time to get out of the house and explore all the fun events and adventures our beautiful city of Omaha, NE has to offer. We have listed a few can’t-miss activities for you to check out below. Spend the weekend tasting delicious new recipes on a walking food tour, try a new tune at karaoke, pick up fresh, local food at the farmer’s market and go backstage at the aquarium for a day to remember!  With warm weather and sunshine (finally) staying consistent in our forecast, this is the perfect time of year to get out of the house and spend some quality time outdoors with family and friends. We have listed fifteen of our favorite parks in and around Omaha, NE below that we know you will enjoy! Whether you are attempting to tire out your toddlers at the playground, take a relaxing stroll in the sun or enjoy a romantic picnic with your significant other, these parks are the perfect place to spend your summer days. Enjoy!

With warm weather and sunshine (finally) staying consistent in our forecast, this is the perfect time of year to get out of the house and spend some quality time outdoors with family and friends. We have listed fifteen of our favorite parks in and around Omaha, NE below that we know you will enjoy! Whether you are attempting to tire out your toddlers at the playground, take a relaxing stroll in the sun or enjoy a romantic picnic with your significant other, these parks are the perfect place to spend your summer days. Enjoy!  Hello, weekend – we sure have missed you! And what perfecting timing for a few days off because there are so many events and adventures happening in and around our beautiful city of Omaha, NE that you will not want to miss! We have listed a few below for you to check out (thank us later!). Spend your weekend perfecting your yoga in the park, doing a walking food tour, laughing at a comedy show, going backstage at the aquarium, enjoying a fashion show and so much more!

Hello, weekend – we sure have missed you! And what perfecting timing for a few days off because there are so many events and adventures happening in and around our beautiful city of Omaha, NE that you will not want to miss! We have listed a few below for you to check out (thank us later!). Spend your weekend perfecting your yoga in the park, doing a walking food tour, laughing at a comedy show, going backstage at the aquarium, enjoying a fashion show and so much more! The home inspection is a crucial part of the buying process. If you have ever brought or sold a house, then you are probably well versed in what a home inspection is and how/why they are conducted. On the other hand, if you are a first-time home buyer, this may be your first time hearing the phrase. And that is where we come in! Whether you are a real estate aficionado and just need a refresher, or you are a newbie trying to understand the lingo, today’s blog post is going to break down everything you need to know about the home inspection process.

The home inspection is a crucial part of the buying process. If you have ever brought or sold a house, then you are probably well versed in what a home inspection is and how/why they are conducted. On the other hand, if you are a first-time home buyer, this may be your first time hearing the phrase. And that is where we come in! Whether you are a real estate aficionado and just need a refresher, or you are a newbie trying to understand the lingo, today’s blog post is going to break down everything you need to know about the home inspection process.  Can you believe we are already half-way through May? We can’t either. And with summer in full swing, now is the perfect time to fill your calendar exploring exciting adventures and creating memories with family and friends. We have listed below some events happening in and around Omaha, NE this weekend that we are sure you will love! You will find everything from baseball games and walking food tours, to wine festivals, live wrestling events, farmers markets, yoga in the park, aquarium exhibits and so much more!

Can you believe we are already half-way through May? We can’t either. And with summer in full swing, now is the perfect time to fill your calendar exploring exciting adventures and creating memories with family and friends. We have listed below some events happening in and around Omaha, NE this weekend that we are sure you will love! You will find everything from baseball games and walking food tours, to wine festivals, live wrestling events, farmers markets, yoga in the park, aquarium exhibits and so much more!