A Guide For First Time Home Buyers In Omaha, NE

If you are looking to purchase your first home in Omaha, NE then you won’t want to miss today’s blog post!

If you are looking to purchase your first home in Omaha, NE then you won’t want to miss today’s blog post!

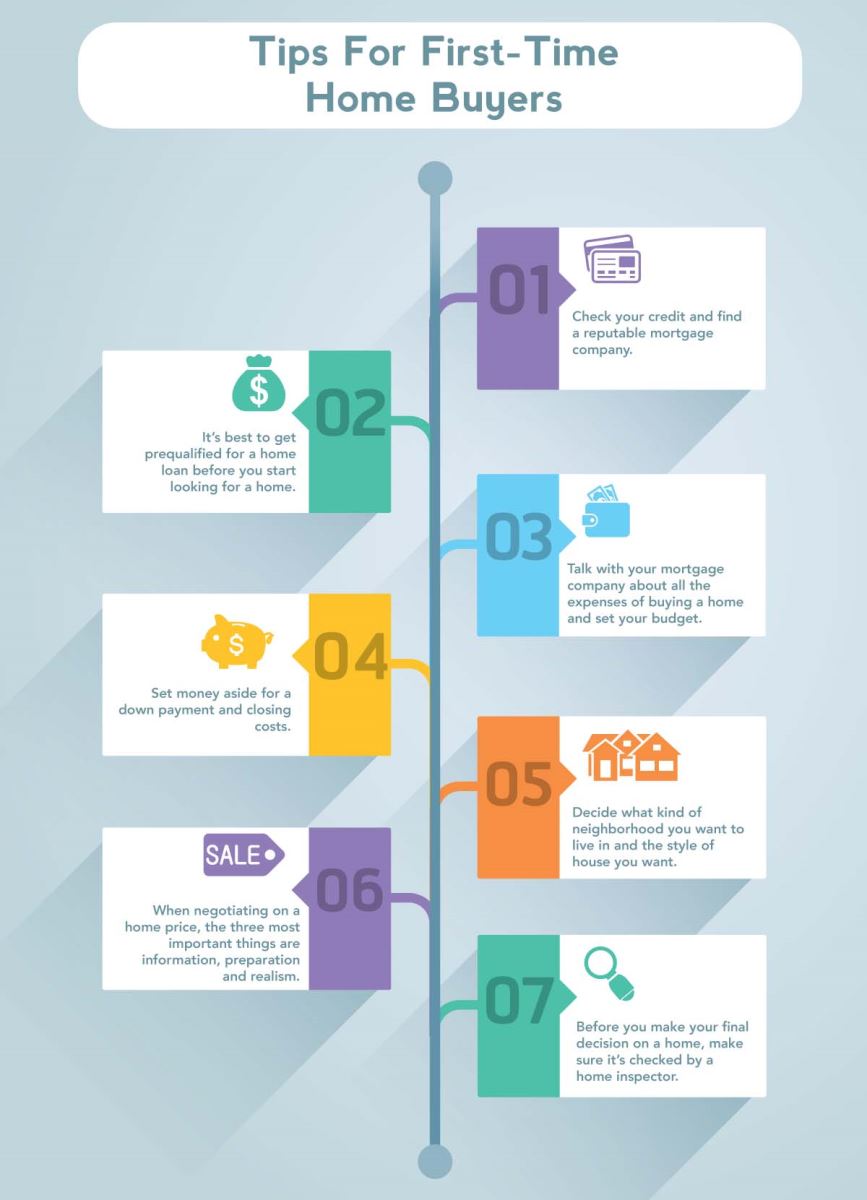

The home buying process for first time buyers is very exciting, yet also can seem daunting and overwhelming at times. That is why we have outlined the process in a few simple steps below in hopes that you can familiarize yourself with what to expect. Ready to find your first home? Let’s dive in!

-The first thing you want to do is get an idea of the type of property you are looking for. This will help you effectively communicate your wants and needs to your realtor and keep you from wasting your time at showings that ultimately will not interest you.

-Next, find a great real estate agent. This step is crucial because not only will you be spending a lot of time with your realtor, but you want to find someone that has extensive knowledge of the area, is hard working and will work in your best interest. Your relationship with your real estate agent will be the foundation of your home buying process, so make sure you find someone you can trust.

-Find a lender and work with your loan agent to figure out which mortgage is right for you. You will then follow the application process and submit all required material.

-This is where the fun starts – find your dream home! Your agent will begin setting up showings with potential properties that fit your criteria and budget.

-Once you find a property that you love you will work with your real estate agent to craft an offer on the home. The offer will have specifics such as price, proposed settlement date and contingencies.

From new, modern homes to old fixer-uppers - whatever your taste let our experienced team help you find your dream home in Omaha, NE. Be sure to sign up for our listing alerts here!

As if the process of moving isn’t difficult enough, adding children into the mix can be a daunting and stressful recipe. But with the right preparation and planning you can make it a fun and exciting journey for your whole family to enjoy. That is where we come in!

As if the process of moving isn’t difficult enough, adding children into the mix can be a daunting and stressful recipe. But with the right preparation and planning you can make it a fun and exciting journey for your whole family to enjoy. That is where we come in! Many people are attracted to older homes due to their character, charm and unique design elements, and much prefer this purchase over a newer, more modern property. And while all homes have their fair share of upkeep and issues from time to time, older homes are more prone to costly renovations and repairs.

Many people are attracted to older homes due to their character, charm and unique design elements, and much prefer this purchase over a newer, more modern property. And while all homes have their fair share of upkeep and issues from time to time, older homes are more prone to costly renovations and repairs.  It is no secret that buying a home is one of the biggest purchases you will make in your lifetime. And with the right real estate agent and professional guidance, it can also be one of the most exciting times for you and your family as you navigate the home buying process.

It is no secret that buying a home is one of the biggest purchases you will make in your lifetime. And with the right real estate agent and professional guidance, it can also be one of the most exciting times for you and your family as you navigate the home buying process.  No matter if it’s your first or sixth time purchasing a property, the process of buying a home can be exciting, stressful and seem like a roller coaster of mixed emotions. And while we live in a digital age, it is important to know that the internet will not replace the guidance and expertise of a knowledgeable real estate agent during your home buying journey in beautiful Omaha, NE.

No matter if it’s your first or sixth time purchasing a property, the process of buying a home can be exciting, stressful and seem like a roller coaster of mixed emotions. And while we live in a digital age, it is important to know that the internet will not replace the guidance and expertise of a knowledgeable real estate agent during your home buying journey in beautiful Omaha, NE.  Whether you are relocating to Omaha, NE from another state or just moving minutes up the road, there are a few key factors to consider when choosing a new neighborhood to settle into. And since narrowing down a part of town you want to be in can be tricky, we have listed a few things to keep in mind and research before deciding on an area:

Whether you are relocating to Omaha, NE from another state or just moving minutes up the road, there are a few key factors to consider when choosing a new neighborhood to settle into. And since narrowing down a part of town you want to be in can be tricky, we have listed a few things to keep in mind and research before deciding on an area: We understand just how stressful the home buying journey can be – from setting a budget to finding your perfect neighborhood, to touring potential houses and finally landing the home of your dreams – it is a process to say the least! But when the finish line is finally in sight you don’t want to forget one crucial step, the final walkthrough.

We understand just how stressful the home buying journey can be – from setting a budget to finding your perfect neighborhood, to touring potential houses and finally landing the home of your dreams – it is a process to say the least! But when the finish line is finally in sight you don’t want to forget one crucial step, the final walkthrough.  There are few events in life more exciting, momentous and nerve-racking than buying your first home. You may be combing the web for the ideal school district or find yourself driving around neighborhoods trying to picture which cul-de-sac you could settle into. However, there are also moments where, especially for first time home buyers, you may feel overwhelmed and confused by the process.

There are few events in life more exciting, momentous and nerve-racking than buying your first home. You may be combing the web for the ideal school district or find yourself driving around neighborhoods trying to picture which cul-de-sac you could settle into. However, there are also moments where, especially for first time home buyers, you may feel overwhelmed and confused by the process. .jpg) The home buying process, while stressful at times, should be a fun and exciting time for you and your family. Touring new potential homes is a great way to see if each would be a good fit for your needs, but there are also certain things to pay special attention to while touring the property. Below we have listed a few things for you to keep in mind during your walk through:

The home buying process, while stressful at times, should be a fun and exciting time for you and your family. Touring new potential homes is a great way to see if each would be a good fit for your needs, but there are also certain things to pay special attention to while touring the property. Below we have listed a few things for you to keep in mind during your walk through: It’s true when they say that buying a house is one of the largest financial investments most people will make in their lifetime. With that said, it comes as no surprise when people have a cautious approach to the home buying process and want to gather as much information as possible before they sign on the dotted line. This is especially true for first time home buyers as they navigate the mix of excitement and nerves of owning their first property.

It’s true when they say that buying a house is one of the largest financial investments most people will make in their lifetime. With that said, it comes as no surprise when people have a cautious approach to the home buying process and want to gather as much information as possible before they sign on the dotted line. This is especially true for first time home buyers as they navigate the mix of excitement and nerves of owning their first property.