What Does That Really Mean? Breaking Down Five Mortgage Closing Terms

Monday, May 13, 2019

We understand how confusing the home buying process can seem, especially for first time home buyers. And along your journey you may find new words and phrases being thrown in your direction that you have never heard before - let alone know how to define – and it makes everything seem a little more, well, complicated. We get it and that is why we have dedicated today’s blog post to simplifying five common mortgage closing terms. Our hope is that alongside this newfound knowledge will come confidence and understanding, in turn allowing you to enjoy the buying process a little more!

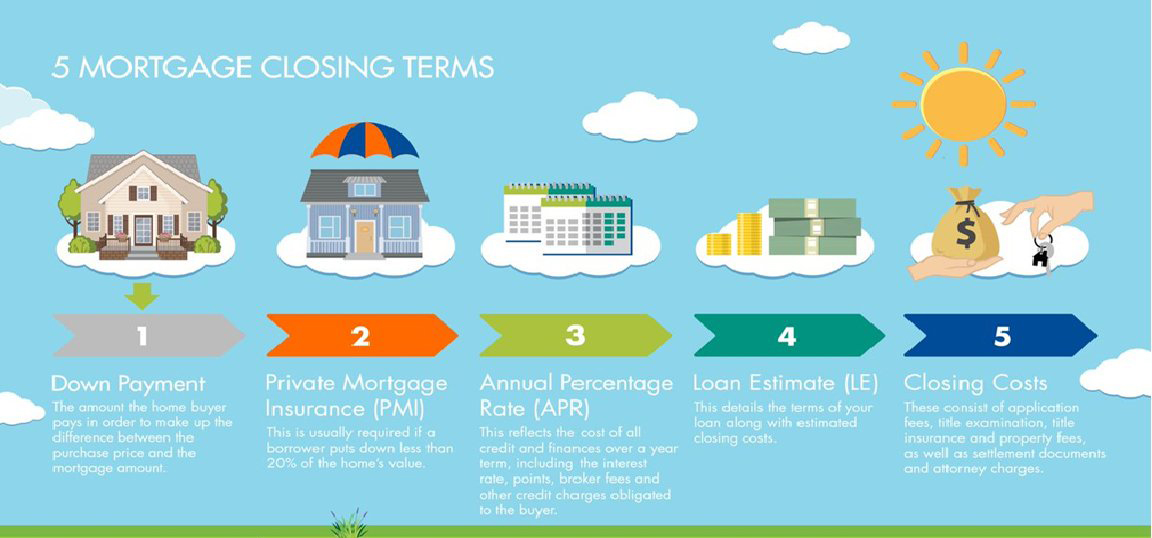

We understand how confusing the home buying process can seem, especially for first time home buyers. And along your journey you may find new words and phrases being thrown in your direction that you have never heard before - let alone know how to define – and it makes everything seem a little more, well, complicated. We get it and that is why we have dedicated today’s blog post to simplifying five common mortgage closing terms. Our hope is that alongside this newfound knowledge will come confidence and understanding, in turn allowing you to enjoy the buying process a little more! 1.) Down Payment – This phrase refers to the money a home buyer must provide up-front in order to secure the amount that is being borrowed. Additionally, to be approved for a home loan, most mortgage lenders require a cash down payment ranging from 3%-20%.

2.) Private Mortgage Insurance (PMI) – Some home buyers will be required to pay private mortgage insurance when they take out a conventional home loan, typically if they are putting down less than 20% of the home’s value. This insurance is used as protection for lenders in case you end up in foreclosure.

3.) Annual Percentage Rate (APR) – APR is a broad measure of the cost you, as the borrower, of taking out a loan. It could refer to costs such as broker fees, interest rate, points, etc.

4.) Loan Estimate (LE) – The loan estimate refers to the details of the agreed upon terms of your loan, in addition to the estimated closing costs.

5.) Closing Costs – Both the buyer and the seller pay closing costs, and they can include things such as property fees, application fees, title insurance, title examination, attorney charges and settlement documents.