First-Time Homebuyers: Why December 2025 Could Be Your Best Entry Point in Years

First-Time Homebuyers: Why December 2025 Could Be Your Best Entry Point in Years

If you're stepping into homeownership for the first time, December 2025 may offer a window of opportunity that we haven't seen in years — especially here in Omaha.

Affordability Is Still a Local Advantage

Home prices in Omaha remain significantly more approachable than in many parts of the country. The median sale price currently sits around $285,000, up 5.6% from last year — but that's still 35% lower than the national average. Even with year-over-year increases, the metro area continues to offer solid value for first-time buyers without sacrificing lifestyle, amenities, or community feel.

For context, that median price in Omaha buys you a completely different lifestyle than it would in coastal markets or even many Midwest cities. You're not just getting a house — you're getting space, good schools, and genuine community.

Inventory Growth Means Real Choice

There are currently 402 homes for sale in Omaha, and new listings jumped 40.6% this month. After years of scrambling for anything available, rising inventory means you're no longer forced to choose the "best available" option — you can pursue the home that genuinely suits your checklist. Whether that's a larger yard, finished basement, updated kitchen, or specific neighborhood, selection is improving.

Homes Are Still Selling — But Not at the Sprint Pace of the Past

Homes in Omaha currently sell in around 22 days on the market compared to 15 days last year. In today's market, well-priced homes still move quickly, but buyers no longer have to jump within hours or waive every contingency just to compete. This breathing room is a huge win for first-time buyers who need time to get inspections, secure financing, and make informed decisions.

Where First-Time Buyers Are Finding Success

Let's get specific about neighborhoods where first-time buyers are actually purchasing right now:

Benson ($220,000-$275,000) This historic district is experiencing a renaissance with home prices averaging around $225,000, making it one of the most affordable up-and-coming areas. The walkability score has jumped significantly thanks to the thriving restaurant scene, breweries, and local businesses. Perfect for buyers who want character, community, and urban convenience without the downtown price tag.

Leavenworth ($240,000-$300,000) This area features a mix of historic homes and newly renovated properties, which makes it an attractive option for both families and first-time homebuyers. The walkability allows residents to access local parks, cafes, and shopping without relying on a car. As the area continues to develop, additional amenities and recreational options are coming online to meet growing demand.

Papillion ($280,000-$350,000) Papillion has topped lists of best places to live in Nebraska, and it's only about 20 minutes from downtown Omaha. Families love the highly-rated public schools, low crime rates, and great job opportunities. If you're a first-time buyer looking for a place to put down long-term roots, this is where your dollar stretches while still getting top-tier amenities.

Bellevue ($260,000-$320,000) Located just 8 miles south of downtown, Bellevue offers about a 20-minute commute to the city's employment and entertainment centers. This combination of convenience for work and excellent amenities makes Bellevue one of the most desirable neighborhoods in the Omaha metro area. It consistently ranks as one of the most diverse neighborhoods in Nebraska and one of the best for young professionals.

Gretna ($300,000-$380,000) Located approximately 20 miles southwest of Omaha, this up-and-coming area offers the perfect balance between small-town ambiance and modern convenience, with an ultra-friendly atmosphere and an excellent school district. Many first-time buyers are willing to stretch their budget here for the school quality and newer construction options.

Blackhawk (Bellevue) ($275,000-$340,000) This neighborhood is more than just a community — it's got a heartbeat, where kids grow up riding bikes to school, neighbors gather in driveways for outdoor parties, and Halloween becomes a full-blown event with legendary trick-or-treating. Great for first-time buyers who value tight-knit community feel.

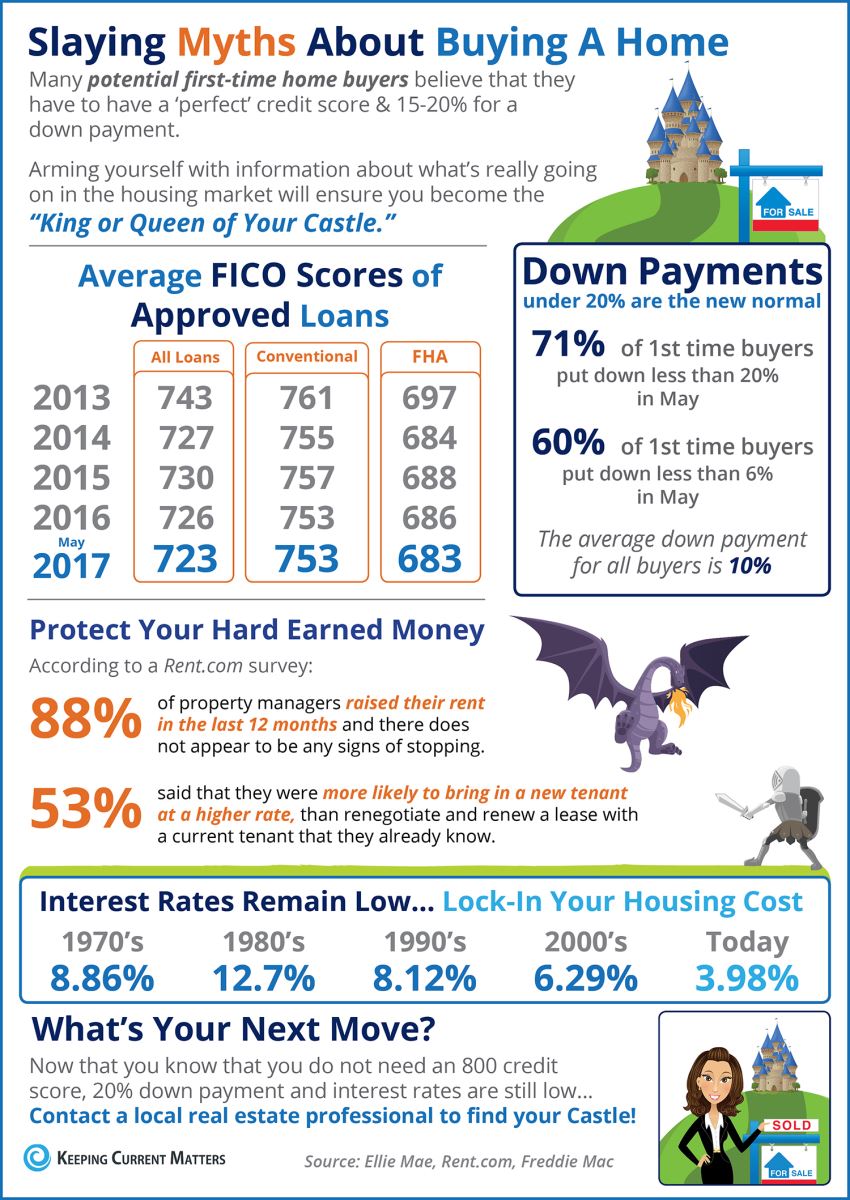

Programs That Make It Possible

Don't overlook the financial assistance available specifically for Nebraska first-time buyers:

NIFA First Home Program The Nebraska Investment Finance Authority offers competitive interest rates and down payment assistance to help first-time homebuyers purchase their first home. You'll need to complete a homebuyer education class and meet income limits based on household size and location, but the savings can be substantial.

Homebuyer Assistance Program (HBA) This program opens the door to homeownership even if you don't have a down payment or money for closing costs, providing up to 5% of the home's purchase price through a second mortgage. The interest rate on the first mortgage is slightly higher to cover the assistance, but it eliminates the biggest barrier for many first-time buyers.

City of Omaha Programs The City of Omaha partners with Omaha 100, Inc. to provide homebuyers with financial guidance, low-interest rates on home loans, down payment assistance, and city-backed second mortgages. Contact them early in your search to understand your options.

Smart Strategies for First-Timers This Month

Get pre-approved before you start touring. Winter is a great time to negotiate, but only if you're ready to move. Sellers are more motivated in December and January, but they're also more skeptical of buyers who aren't serious.

Prioritize long-term value over cosmetic appeal. Look beyond finishes and consider school districts, nearby development, and neighborhood appreciation. A house with dated countertops in Papillion or Elkhorn will likely appreciate better than a fully updated home in a declining area.

Be open to "almost perfect" homes. With more inventory, small improvements could turn a near-miss into your ideal home. That extra bedroom or finished basement might be more negotiable now than it would have been 18 months ago.

Work with someone who knows the micro-markets. National trends don't tell you whether a specific street in Benson is about to boom or whether that Bellevue listing is priced right. Local expertise matters more than ever when inventory gives you real choices.

Use the winter slowdown to your advantage. Sellers who list during the holidays are typically motivated. Whether it's a job relocation, family situation, or financial need, December listings tend to be more negotiable than spring listings from sellers who can afford to wait.

Bottom Line

December 2025 and January 2026 offer a balanced, opportunity-rich season for first-time buyers in Omaha — a rare mix of selection, stability, and negotiating power. You're not fighting through bidding wars, you have actual neighborhood options in the $225K-$350K range, and programs exist specifically to help you overcome down payment barriers.

The homes are here. The financing is available. The question is whether you're ready to move while the window is open.