What To Do After You Purchase Your First Omaha, NE Home

.jpg) There is no better feeling than signing the final paperwork on your first home! And while the difficult hunt of finding your perfect property is over, there are still many items to check off your ‘to-do’ list before you can kick your feet up.

There is no better feeling than signing the final paperwork on your first home! And while the difficult hunt of finding your perfect property is over, there are still many items to check off your ‘to-do’ list before you can kick your feet up.

We have dedicated today’s blog post to a list of items for you to consider after you purchase your first Omaha, NE home. Let’s dive in!

-One of the first things you want to do after purchasing your Omaha, NE home is to change the locks and garage codes. This will ensure no one with previous access to the home is able to enter moving forward. You may also consider updating the home technology such as the security system for an added layer of protection.

-You will want to use your home inspection report as a guide to address any issues that were flagged, and the seller did not fix. You don’t have to tackle these all at once – you can prioritize what needs to be completed on what timeline and gradually check items off.

-Be sure to connect the utilities, such as electricity and gas, prior to your move in date. This will make for a smooth transition as you settle into your new abode.

-Don’t forget to check carbon monoxide and smoke detectors to ensure they are in good working condition. You may need to change out the batteries or consider replacing the entire units if you feel they need to be updated.

-Prior to your move in date you may consider hiring a professional team to deep clean the space before your belongings are hauled in. You can’t be sure what dust and/or allergens have accumulated and it’s always good to start with a clean, clear space.

-In case of emergencies, be sure to familiarize yourself with emergency shut-offs, appliance manuals and the circuit box right when you move in. The least ideal time to search for these is in moments when you need them!

-Lastly, don’t forget to update places such as your employer, insurance companies and banking institutions with your new address. Additionally, if you are moving from out of state be sure to set a date to visit the local DMV to update your license.

Are you interested in hearing what our amazing clients are saying about us? Be sure to check out the Testimonials page here!

If you are a first-time home buyer you may come across words or phrases during the buying process that you are unfamiliar with, thus causing a level of confusion and unnecessary stress. Two of those terms may be pre-qualified and pre-approved – and while they sound similar, it is crucial that you understand the differences.

If you are a first-time home buyer you may come across words or phrases during the buying process that you are unfamiliar with, thus causing a level of confusion and unnecessary stress. Two of those terms may be pre-qualified and pre-approved – and while they sound similar, it is crucial that you understand the differences. If you are looking to purchase your first home in Omaha, NE then you won’t want to miss today’s blog post!

If you are looking to purchase your first home in Omaha, NE then you won’t want to miss today’s blog post!  There are few events in life more exciting, momentous and nerve-racking than buying your first home. You may be combing the web for the ideal school district or find yourself driving around neighborhoods trying to picture which cul-de-sac you could settle into. However, there are also moments where, especially for first time home buyers, you may feel overwhelmed and confused by the process.

There are few events in life more exciting, momentous and nerve-racking than buying your first home. You may be combing the web for the ideal school district or find yourself driving around neighborhoods trying to picture which cul-de-sac you could settle into. However, there are also moments where, especially for first time home buyers, you may feel overwhelmed and confused by the process.  It’s true when they say that buying a house is one of the largest financial investments most people will make in their lifetime. With that said, it comes as no surprise when people have a cautious approach to the home buying process and want to gather as much information as possible before they sign on the dotted line. This is especially true for first time home buyers as they navigate the mix of excitement and nerves of owning their first property.

It’s true when they say that buying a house is one of the largest financial investments most people will make in their lifetime. With that said, it comes as no surprise when people have a cautious approach to the home buying process and want to gather as much information as possible before they sign on the dotted line. This is especially true for first time home buyers as they navigate the mix of excitement and nerves of owning their first property.  Let’s be honest - no matter how you spin it, buying a home is not cheap. And whether you are a first-time homebuyer or a seasoned professional, we are sure the previous sentence comes as no surprise to you (you may have even found yourself nodding and smirking in agreeance). But what many people tend to focus on are the larger costs that are associated with home buying, such as mortgage payments and down payment costs, and many tend to overlook the lesser fees that may arise during the buying process. But fear not, as after today’s blog post we are confident you will leave with a better, more thorough understanding of not only what these fees are, but also what they could end up costing, so you can plan accordingly.

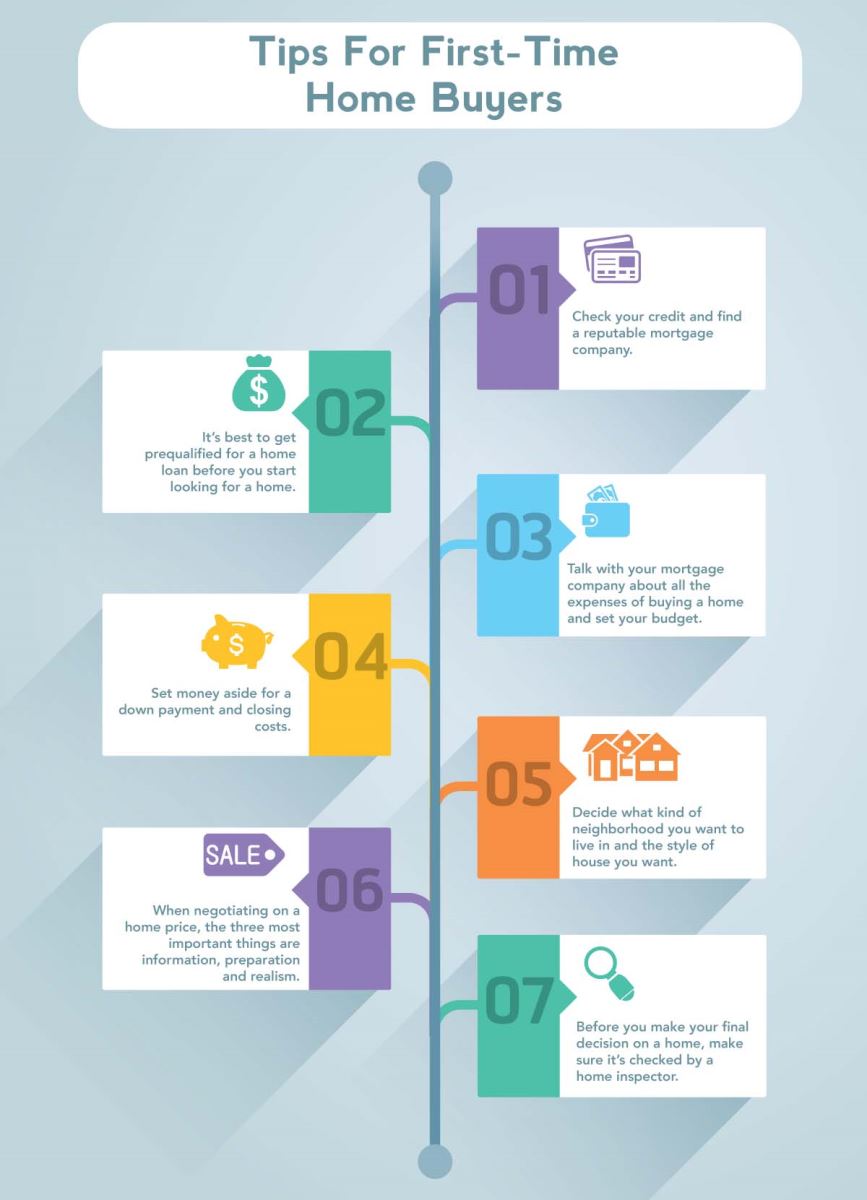

Let’s be honest - no matter how you spin it, buying a home is not cheap. And whether you are a first-time homebuyer or a seasoned professional, we are sure the previous sentence comes as no surprise to you (you may have even found yourself nodding and smirking in agreeance). But what many people tend to focus on are the larger costs that are associated with home buying, such as mortgage payments and down payment costs, and many tend to overlook the lesser fees that may arise during the buying process. But fear not, as after today’s blog post we are confident you will leave with a better, more thorough understanding of not only what these fees are, but also what they could end up costing, so you can plan accordingly.  So the time has finally come to start the search for your first home. Your mind starts racing as you begin thinking of the style you like, the finishes you want, and how you will decorate to turn the house into your very own home. What an exciting time! As you begin your search, we wanted to leave you with a few tips and tricks that we hope will prove to be helpful during a time that can seem a little overwhelming. Enjoy!

So the time has finally come to start the search for your first home. Your mind starts racing as you begin thinking of the style you like, the finishes you want, and how you will decorate to turn the house into your very own home. What an exciting time! As you begin your search, we wanted to leave you with a few tips and tricks that we hope will prove to be helpful during a time that can seem a little overwhelming. Enjoy!