Tips For First Time Home Buyers In Omaha, NE

There are few events in life more exciting, momentous and nerve-racking than buying your first home. You may be combing the web for the ideal school district or find yourself driving around neighborhoods trying to picture which cul-de-sac you could settle into. However, there are also moments where, especially for first time home buyers, you may feel overwhelmed and confused by the process.

There are few events in life more exciting, momentous and nerve-racking than buying your first home. You may be combing the web for the ideal school district or find yourself driving around neighborhoods trying to picture which cul-de-sac you could settle into. However, there are also moments where, especially for first time home buyers, you may feel overwhelmed and confused by the process.

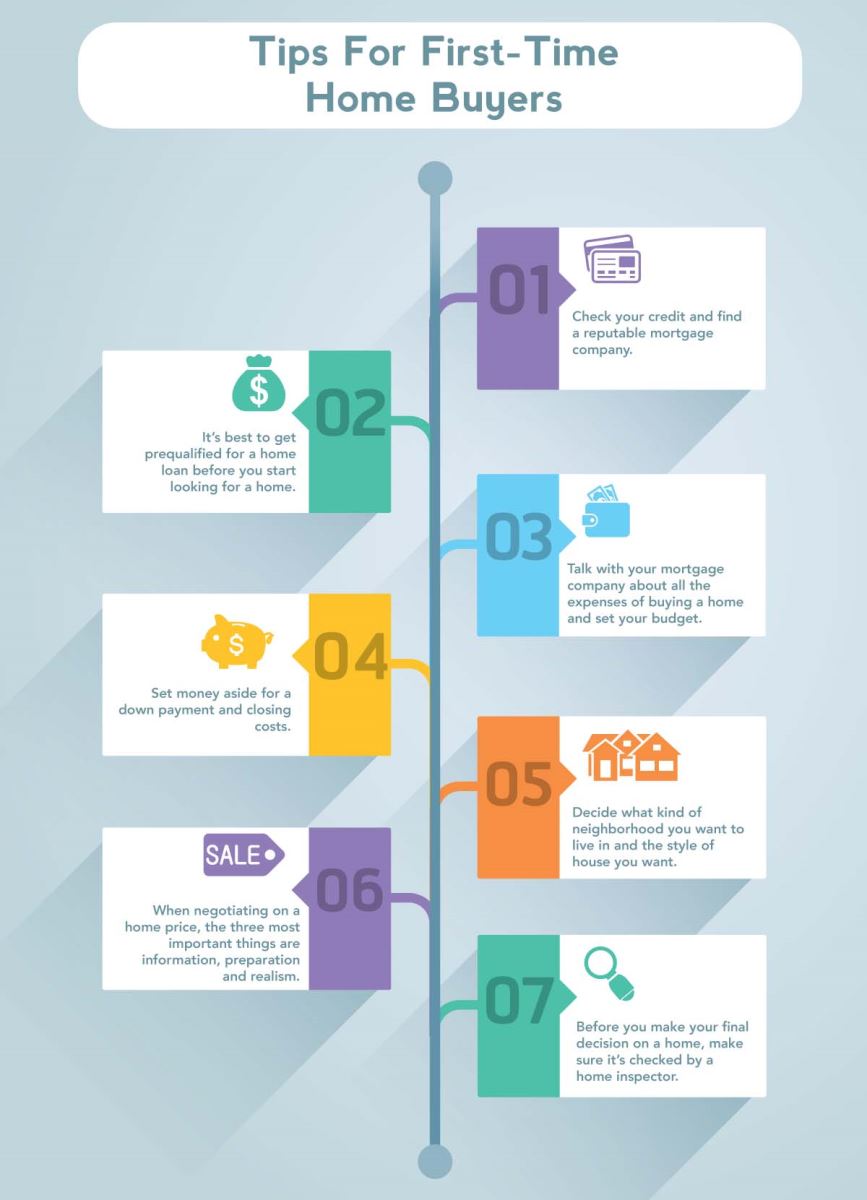

In an effort to settle some nerves and calm potential anxiety, we have focused this blog post on discussing tips for first time home buyers:

-Our first tip for you is to start saving early for your down payment. It is common to put around twenty percent of the purchase price down, so starting to save early on can help be a big asset. Your future self will thank you!

-Check on your credit. Many people don’t realize how big of a factor their credit score is on the approval process for a mortgage loan. Staying on top of your credit score and improving areas that need some work will help you when you to go apply for a mortgage.

-Figure out how much you qualify for before you start house shopping. The worst feeling is to get emotionally attached to a home you can’t afford, so knowing where you stand and what you can afford will make the process a little smoother.

-Prior to starting your home search, take a few minutes and write out a list of the non-negotiables you want in your home. This can be anything from location to square footage – anything that you can’t live without in your next abode. It will not only force you to narrow in on what you are looking for, but it will also help your realtor get a better idea of what to start showing you.

-Find the right realtor. You will find throughout the home buying process that your realtor becomes your new best friend. We can’t stress enough how important it is to have a knowledgeable, hardworking, honest and committed agent by your side. It really will make all the difference.

-Our last tip for you is to have fun and enjoy the process!

The fun doesn't have to stop here! If you want more home buying tips check out our "Omaha Nebraska Home Buying Tips" page here!

.jpg) The home buying process, while stressful at times, should be a fun and exciting time for you and your family. Touring new potential homes is a great way to see if each would be a good fit for your needs, but there are also certain things to pay special attention to while touring the property. Below we have listed a few things for you to keep in mind during your walk through:

The home buying process, while stressful at times, should be a fun and exciting time for you and your family. Touring new potential homes is a great way to see if each would be a good fit for your needs, but there are also certain things to pay special attention to while touring the property. Below we have listed a few things for you to keep in mind during your walk through: It’s true when they say that buying a house is one of the largest financial investments most people will make in their lifetime. With that said, it comes as no surprise when people have a cautious approach to the home buying process and want to gather as much information as possible before they sign on the dotted line. This is especially true for first time home buyers as they navigate the mix of excitement and nerves of owning their first property.

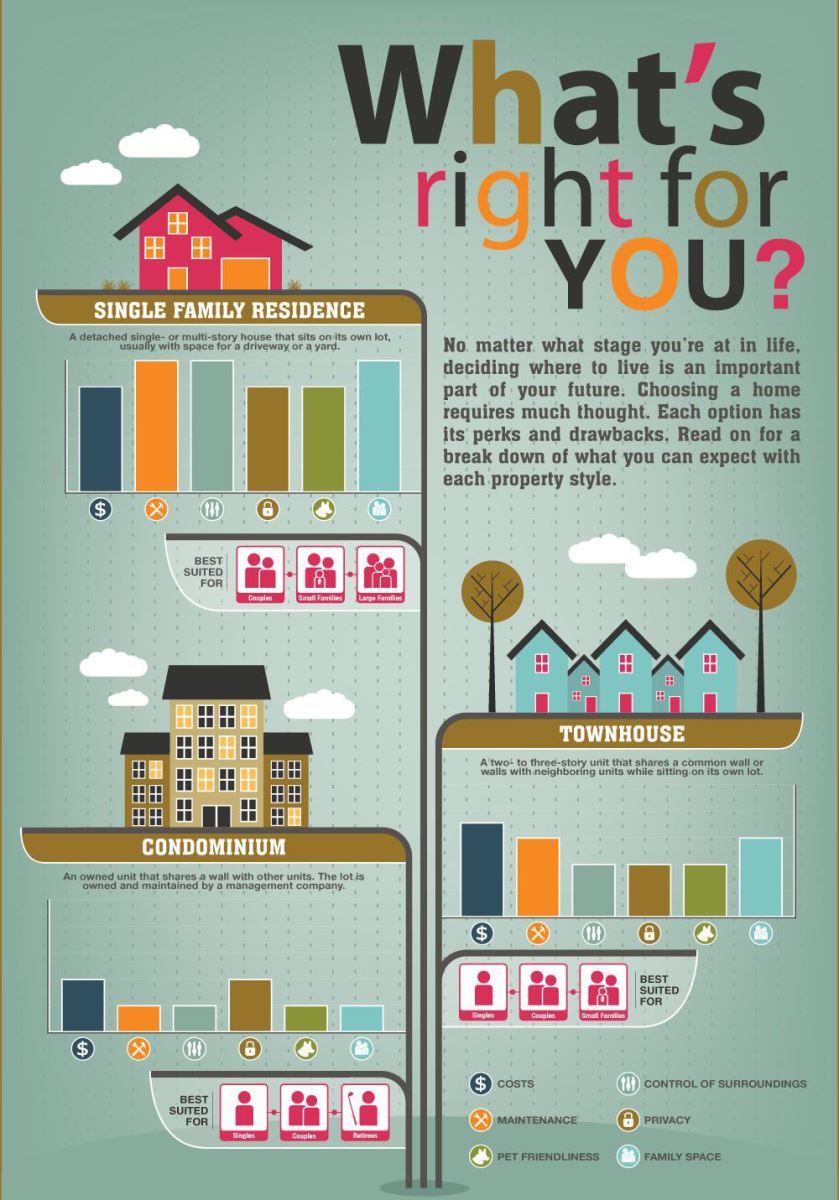

It’s true when they say that buying a house is one of the largest financial investments most people will make in their lifetime. With that said, it comes as no surprise when people have a cautious approach to the home buying process and want to gather as much information as possible before they sign on the dotted line. This is especially true for first time home buyers as they navigate the mix of excitement and nerves of owning their first property.  If you are in the market to purchase a single-family home, townhouse or condo in the Omaha, NE area, there are a few important differences that you should understand before starting your search. We have listed them below for you to review and hope the information helps you to get a better understanding of which option would work best for your situation!

If you are in the market to purchase a single-family home, townhouse or condo in the Omaha, NE area, there are a few important differences that you should understand before starting your search. We have listed them below for you to review and hope the information helps you to get a better understanding of which option would work best for your situation!  It’s official – you have finally found, closed on and moved into the home of your dreams in Omaha, NE. We think a congratulations are in order as that is no small feat! But once the celebratory Champaign bubbles have fizzled out and all the boxes have been put away, it is now time to ensure that a few things are in order in your new abode. Below we have listed a couple items for you to tackle in the areas of security, home documents, emergency planning and maintenance to not only help keep you organized, but also avoid any costly home repairs down the road.

It’s official – you have finally found, closed on and moved into the home of your dreams in Omaha, NE. We think a congratulations are in order as that is no small feat! But once the celebratory Champaign bubbles have fizzled out and all the boxes have been put away, it is now time to ensure that a few things are in order in your new abode. Below we have listed a couple items for you to tackle in the areas of security, home documents, emergency planning and maintenance to not only help keep you organized, but also avoid any costly home repairs down the road.  Let’s be honest - no matter how you spin it, buying a home is not cheap. And whether you are a first-time homebuyer or a seasoned professional, we are sure the previous sentence comes as no surprise to you (you may have even found yourself nodding and smirking in agreeance). But what many people tend to focus on are the larger costs that are associated with home buying, such as mortgage payments and down payment costs, and many tend to overlook the lesser fees that may arise during the buying process. But fear not, as after today’s blog post we are confident you will leave with a better, more thorough understanding of not only what these fees are, but also what they could end up costing, so you can plan accordingly.

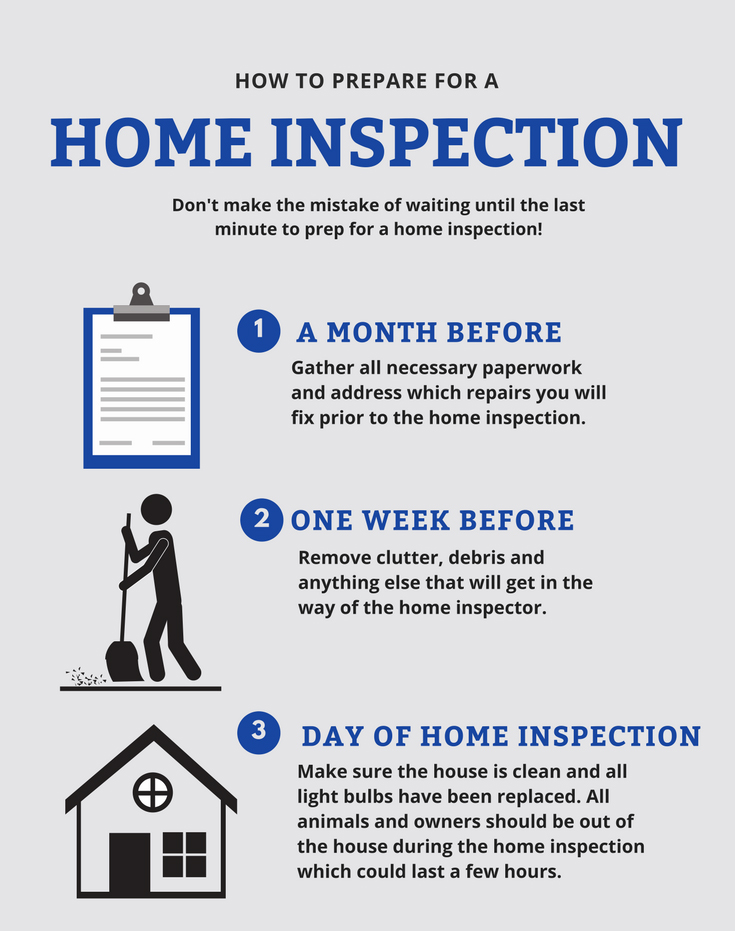

Let’s be honest - no matter how you spin it, buying a home is not cheap. And whether you are a first-time homebuyer or a seasoned professional, we are sure the previous sentence comes as no surprise to you (you may have even found yourself nodding and smirking in agreeance). But what many people tend to focus on are the larger costs that are associated with home buying, such as mortgage payments and down payment costs, and many tend to overlook the lesser fees that may arise during the buying process. But fear not, as after today’s blog post we are confident you will leave with a better, more thorough understanding of not only what these fees are, but also what they could end up costing, so you can plan accordingly.  The home inspection is a crucial part of the buying process. If you have ever brought or sold a house, then you are probably well versed in what a home inspection is and how/why they are conducted. On the other hand, if you are a first-time home buyer, this may be your first time hearing the phrase. And that is where we come in! Whether you are a real estate aficionado and just need a refresher, or you are a newbie trying to understand the lingo, today’s blog post is going to break down everything you need to know about the home inspection process.

The home inspection is a crucial part of the buying process. If you have ever brought or sold a house, then you are probably well versed in what a home inspection is and how/why they are conducted. On the other hand, if you are a first-time home buyer, this may be your first time hearing the phrase. And that is where we come in! Whether you are a real estate aficionado and just need a refresher, or you are a newbie trying to understand the lingo, today’s blog post is going to break down everything you need to know about the home inspection process.  There is no denying the endless entertainment, activities and adventures that our beautiful city of Omaha, NE offers its residents and guests of the area. But when looking to buy a house, there are a few neighborhood amenities and other items you will want to look into to ensure that specific area is right for you and your family. We have listed below a few of these below in hopes that you will feel better prepared and that fewer surprises will pop up when going to buy a home!

There is no denying the endless entertainment, activities and adventures that our beautiful city of Omaha, NE offers its residents and guests of the area. But when looking to buy a house, there are a few neighborhood amenities and other items you will want to look into to ensure that specific area is right for you and your family. We have listed below a few of these below in hopes that you will feel better prepared and that fewer surprises will pop up when going to buy a home! Homeowners Associations (HOA’s) – many people love them, many people are not a fan. But before you decide which side of the line you stand on, let’s first discuss some details about what an HOA is and a few of the pros and cons surrounding living in a development with one. Let’s dive right in!

Homeowners Associations (HOA’s) – many people love them, many people are not a fan. But before you decide which side of the line you stand on, let’s first discuss some details about what an HOA is and a few of the pros and cons surrounding living in a development with one. Let’s dive right in!  For first time home buyers, the feelings of excitement for their new abode can often be accompanied (and at times overshadowed) by feeling nervous and overwhelmed by the whole home buying process. Fear not, this is totally normal! However, with a little knowledge under your belt, the whole process can begin to feel more familiar - thus calming the nerves – and allowing you to get back to enjoying the experience. And as you may have guessed, that is exactly what we are going to be chatting about in today’s blog. Below we have listed ten tips to help first time home buyers understand and navigate the home buying process with ease. Enjoy!

For first time home buyers, the feelings of excitement for their new abode can often be accompanied (and at times overshadowed) by feeling nervous and overwhelmed by the whole home buying process. Fear not, this is totally normal! However, with a little knowledge under your belt, the whole process can begin to feel more familiar - thus calming the nerves – and allowing you to get back to enjoying the experience. And as you may have guessed, that is exactly what we are going to be chatting about in today’s blog. Below we have listed ten tips to help first time home buyers understand and navigate the home buying process with ease. Enjoy!